We are occasionally able to see the financial lives and finances of the ultra-rich. A pro athlete signs a huge deal, a tech CEO buys a lot of shares in his company, or a billionaire inheritor sells a Manhattan penthouse. These nuggets of information are used by the media to speculate on how much income the wealthy might make each year. But no one really knows.

A comprehensive analysis of IRS data from the unrivalled collection has led to the discovery of some amazing insights. ProPublicaIt is revealing the 15 people who reported the most U.S. income on their taxes from 2013 to 2018, along with data for the rest of the top 400.

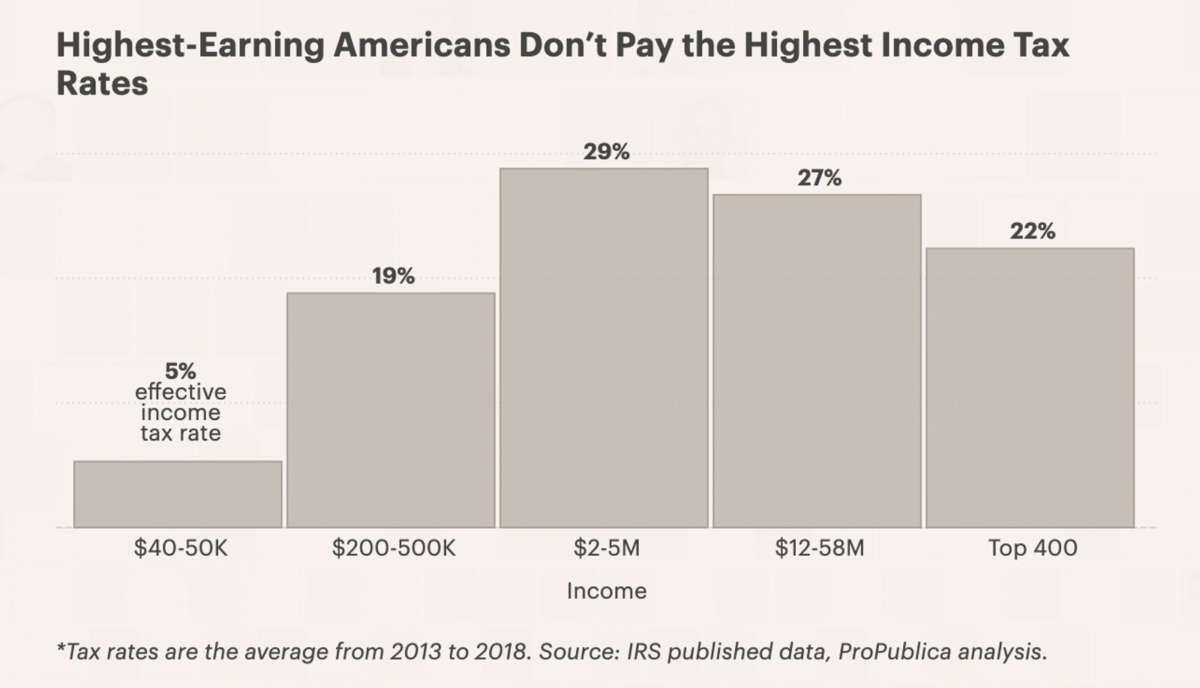

The analysis also shows how much they paid in federal income taxes — and it demonstrates how the American tax system, which theoretically makes the highest earners pay the highest income tax rates, fails to do so for the people at the very top of the income pyramid. The top 400 highest earners pay noticeably less tax than the merely wealthy. A married couple earning $200,000 a years could end up paying more tax than someone earning $200 million ayear. (The full analysis is here; it includes selected names beyond the top 15.)

Names That Won’t Surprise You

Scan the names on the list of the top 15 income earners and you’re certain to recognize several names — or at least the names of the companies they founded. Bill Gates hasn’t been involved in the day-to-day operations of Microsoft for over a decade, yet he still earned the most during the years we studied, reporting an average yearly income of $2.85 billion — and an effective federal income tax rate of 18.4%. Steve BallmerHis former colleague is also a well-known public figure, both in his time as Microsoft CEO and now. ownership of the Los Angeles Clippers NBA team. Ballmer’s average annual reported income of $1.05 billion landed him in the 10th spot on the list, and his effective federal income tax rate was 14.1%. This is the other side to the PC/Mac Wars. Laurene Powell JobsApple founder’s widow Steve Jobs. Her average income of $1.57billion was fifth. She paid an effective 14.8% tax rate. (ProPublicaEveryone mentioned in this article was asked for comment. None of the numbers cited in this article were disputed by anyone. Unless noted, representatives of people named in this piece either declined to comment or declined to comment on record.

Just below Gates, a well-known billionaire is the media and tech mogul and former mayor of New York City Michael BloombergWith an average income of just over $2B, he paid an effective income tax rate at 4.1%. This is the lowest rate among the top 15. (A spokesperson said ProPublica for an earlier article that Bloomberg “pays the maximum tax rate on all federal, state, local and international taxable income as prescribed by law,” and cited Bloomberg’s philanthropic giving.)

Amazon founders’ presence Jeff Bezos — either the first- or second-wealthiest person in America, depending on the day — won’t shock most people, but Bezos’s annual reported income during these years of $832 million put him only at number 15. He paid an effective tax rate of 23.2%; as we’ve previously reportedBezos had such a low income in two recent years that he could pay $0 in federal income tax in those years.

Who are these Other Persons and Why Do They Pay Higher Tax Rates?

The top 15 richest tech billionaires are the most prominent, but the list also includes a third of the top 15 names. Hedge fund managers make up a third of this list, and some of their earnings were just as large. Many of them paid high effective tax rates, especially when compared to other tech sector representatives. Hedge fund managers often make money by short-term trades that are taxed at a higher rate than when tech leaders cash in on long-term investments.

The highest-earning Hedge Funder is Ken GriffinCitadel, founded in Chicago by Founder. He reported an average income of almost $1.7 billion between 2013 and 2018, ranking him fourth on the list. Griffin paid a rate of 29.2% in tax during these years. (A spokesperson for Griffin said the tax rates in the IRS data “significantly understate” what Griffin pays, because they were lowered by charitable contributions and do not reflect local and state taxes. He also said Griffin pays foreign taxes, which aren’t included in IRS calculations of effective tax rate.)

Israel EnglanderMillennium Management co-founder, was paid at a rate of 30.8%, while Two Sigma Investments co-founders were paid at a rate of 30.8%. David Siegel John OverdeckThe respective tax rates paid were 31.6% and 34.2%.

Some of the variation in rates is due to how tax law affects the way people structure their businesses. Publicly traded corporations are subject to income tax at the company level. When it’s passed on to big shareholders, such as tech billionaires, it can come in the form of dividends, which are taxed at lower rates than ordinary income. However, income from certain manufacturing companies or hedge funds flows directly to the owners of the company, who pay taxes on this income, which results in higher effective tax rate.

Where are the Heirs?

Lists of the world’s wealthiest individuals are always heavily populated by heirs, ranging from descendents of old money to scions of more recently minted fortunes. Dozens of heirs were made ProPublica’s list of 400 biggest income earners. 11 spots are claimed by descendants and relatives of Sam Walton (founder of Walmart).

The DeVos family, the heirs of the Amway fortune, also has multiple members in the top 400. Perhaps the most well-known is Betsy DeVosDuring the Donald Trump administration, she was the U.S. Secretary of Education. She was the 389th highest earner during this period, with an annual income of $112 millions.

These heirs are much like the tech giants who top the list. They get their income from long-term investments or dividends, which are subject to lower taxes. Their effective tax rates ranged between 10.6% for Betsy DeVos and a high of 23% for Walmart heirs. Tom Walton.

Don’t Forget the Deductions

A key way top earners have reduced their tax liability is to claim significant deductions, most often in the form large charitable donations. This is especially true for wealthy investors who can make their donations with stock shares. Thanks to a generous provision of the tax code, they can then deduct the full value of the stock at its current price — without having to first sell it and pay capital gains tax.

Michael Bloomberg achieved a 4.1% tax rate from 2013 to 2018. He took annual deductions of over $1 billion, mainly through charitable contributions. From 2013 to 2017, he also wrote off an average of $400 million each year from what he’d paid in state and local taxes. The 2018 tax overhaul limited that deduction to $10,000 — but also introduced a huge new deduction for pass-through companiesBloomberg was a beneficiary of.

Wait — What About the Celebrities?

Media scrutiny is relentless on actors, musicians, and athletes’ earnings. Yet, few celebrities have made it onto the list of the top 400 highest-earning entertainers. They would have to report an annual income of at minimum $110 million.

ProPublica’s trove has data on many celebrities. Basketball star, Kevin Durant, was close to the top 400. LeBron JamesAverage annual income of $96 million was reported by, Grammy-winning singer Taylor SwiftAlso within reach of the top 400 was an actor with an annual income of $82million. Actor George ClooneyTo crack the top 400, he would have to double his $55 million annual income.

The Top 15

Here are the details for the top 15 income earners. Read the full analysis of the top 400 here.

For the full list of America’s top 400 income earners and their tax rates, along with our methodology, click here.