As calls develop for Biden to increase the moratorium on pupil debt, we converse with the Debt Collective’s Astra Taylor and have her new movie for The Intercept, “Your Debt Is Somebody Else’s Asset,” animated by artist Molly Crabapple. The $15 trillion in U.S. family debt is “a type of wealth switch” from the poor to the wealthy, Taylor says. “Individuals are in debt by design.”

This can be a rush transcript. Copy is probably not in its last kind.

AMY GOODMAN: Rights teams and lawmakers are calling on the Biden administration to increase the moratorium on pupil mortgage funds that’s been in place because the pandemic began. The Biden administration introduced in August it might prolong the pause for about 42 million folks, however that extension is about to finish in lower than two months, on January thirty first, 2022, whilst many proceed to battle through the pandemic.

On Wednesday, 200 teams, led by the Pupil Borrower Safety Heart, despatched a letter to Biden saying, quote, “There’s a broad consensus amongst debtors, advocates, trade, regulators, enforcement officers, and lawmakers {that a} rush to renew pupil mortgage funds is a recipe for catastrophe and can lead to widespread confusion and misery for pupil mortgage debtors.”

Additionally this week, a bunch of 14 lawmakers, led by Senator Raphael Warnock of Georgia, referred to as on Biden to waive the curiosity on pupil loans even after fee assortment resumes, writing, quote, “Accumulating pupil mortgage curiosity generally is a daunting problem for debtors with the bottom incomes or the heaviest pupil debt burdens,” unquote. They famous the debt disaster has additionally disproportionately impacted Black, Latinx and Native communities.

Throughout his marketing campaign, Biden vowed to cancel federal pupil mortgage debt and repair the “damaged” pupil mortgage system. However his administration has stated the extension pausing funds by way of subsequent January can be the ultimate one.

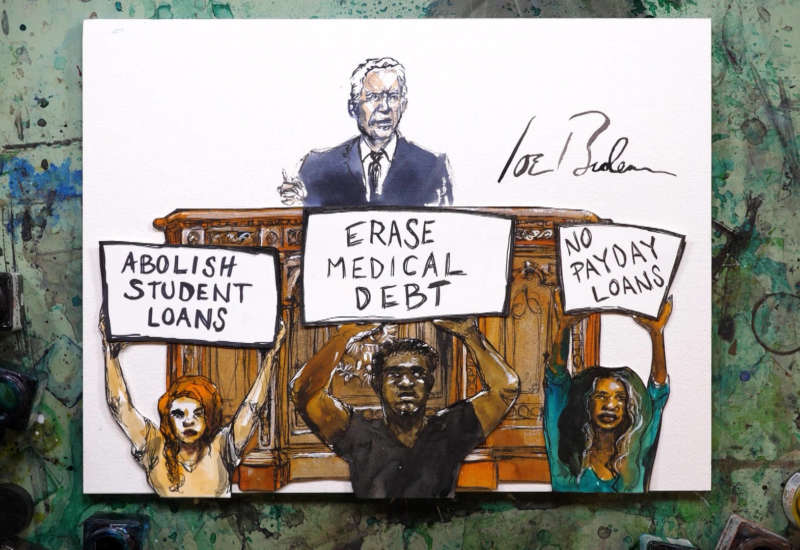

For extra on the debt disaster, we’ll be joined in a minute by Astra Taylor, co-founder of the Debt Collective, a union for debtors. However first, I wish to flip to her new animated brief movie she’s publishing at present at The Intercept, with illustrations by artist Molly Crabapple, referred to as Your Debt Is Somebody Else’s Asset.

ASTRA TAYLOR: The American dream was once proudly owning your personal residence. Now it’s being debt-free. Altogether, People owe a record-breaking $15 trillion and counting. Bought as a lifeline, debt is just too usually an anchor, dragging folks down with compounding curiosity and costs, pulling wealth and assets from the working class to bloat Wall Road’s backside line.

Each debt we maintain is another person’s asset, with our month-to-month funds offering regular income streams for grasping collectors. Households with bank card debt pay round $1,155 a yr in curiosity alone. People now die owing a median of $62,000, a lot of it bank card debt.

A major quantity of the $770 billion of bank card debt slushing round is medical payments — ambulance rides, physician’s visits and surgical procedures paid for with the swipe of a bit plastic card. Then there’s the extra $140 billion of medical debt in collections mixed with an estimated $50 billion in again hire and $1.4 trillion in auto loans.

A lot of this debt didn’t exist just a few generations in the past. Think about the $1.8 trillion in pupil loans this nation now holds, which wasn’t an issue within the Sixties, when faculty was usually free or near it. Ronald Reagan helped change that. He made his identify by demonizing protesters on the College of Berkeley campus. In 1967, as governor of California, he pushed the college system to begin charging college students tuition so they’d, quote, “assume twice” about whether or not they needed to pay to hold a picket signal.

Throughout his profession as senator, Joe Biden superior Reagan’s venture, working to develop pupil lending. As a senator from Delaware, the bank card trade capital, Biden was a faithful servant of the monetary sector. He fought relentlessly for 2005 laws that weakened borrower protections and made chapter tougher for normal debtors, strengthening the hand of the scholar mortgage and bank card industries and serving to trigger a wave of residence foreclosures.

However debt isn’t just about cash. It’s about energy. Debt has lengthy been each a supply of revenue and a software of social management and racial domination. The Founding Fathers knew this. Thomas Jefferson argued that debt needs to be canceled after pure limits, which he took to be a couple of technology — however just for white males like himself. In 1803, he wrote that debt needs to be used as a weapon towards Indigenous folks to steal their territory. “We will … be glad to see the great and influential people amongst them run in debt, as a result of we observe that when these money owed get past what the people will pay, they turn into keen to lop them off by a cession of lands.”

Sharecropping, redlining, predatory lending all continued this pattern, deepening racial inequities. Because of the 2008 mortgage disaster, Black and Brown households misplaced upwards of fifty% of their collective wealth.

For normal debtors, even a late fee can spell catastrophe. A tanked credit score rating could make it not possible to hire an condo or get a job. Default in your pupil loans? The federal government can seize your wages, tax refunds and Social Safety. Debtors’ prisons are technically unconstitutional, however, in apply, folks struggling to pay medical payments or courtroom charges can wind up in jail.

However not all debtors are handled so cruelly. Wealthy folks repeatedly stroll away from their obligations, and corporations interact in strategic defaults. The banks that crashed the financial system in 2008, they bought bailed out. Donald Trump, the self-professed king of debt, left a string of company bankruptcies in his wake. And don’t neglect that through the COVID pandemic the federal authorities spent a whole lot of billions of {dollars} shopping for up dangerous company debt belonging to entities together with Exxon and Walmart and providing firms, together with payday lenders, forgivable loans.

It’s time common debtors bought a break, too. It’s time for a jubilee, the erasure of money owed and a rebalancing of energy between common folks and elites. It’s not a brand new thought. Jubilee was described within the Bible, and lots of historic civilizations had periodic jubilees to avert social and financial collapse. Our earliest recorded histories are stone tablets inscribed with credit score ledgers. Practically so long as debt has existed, debt cancellation has existed, too.

All through historical past, debtors have risen as much as demand reduction. Within the early sixth century BCE, a debtors’ riot helped nudge Historical Athens in direction of democracy. The reforms, often known as the shaking off of burdens, included debt absolution and an finish to debt bondage. One thing comparable occurred in Historical Rome after debtors mounted the world’s first normal strike. In the US, indebted employees and farmers revolted within the colonial period after which once more through the Nice Melancholy. Later, the decision for debt cancellation rang out at Occupy Wall Road. Lately, putting debtors helped power the federal government to cancel billions of {dollars} in pupil loans.

Abolishing medical debt, again hire and pupil loans would unencumber cash now spent on debt servicing for different issues. Individuals might purchase properties and begin households, and the racial wealth hole would chop. Analysis estimates that canceling pupil debt alone would enhance the financial system by as much as $108 billion a yr and create 1,000,000 jobs.

Underneath strain from activists, President Biden campaigned on a promise to cancel a direct minimal of $10,000 of pupil debt per borrower. Due to the Greater Training Act of 1965, he has the ability to cancel all federal pupil loans. With the only signature on an government order, President Biden can free folks from pupil debt, giving tens of tens of millions of individuals their lives and futures again. Now we have to make him do it and rather more. We deserve nothing lower than a jubilee.

AMY GOODMAN: That’s the brand new animated brief movie, Your Debt Is Somebody Else’s Asset, published at present at The Intercept, with illustrations, outstanding illustrations, by the artist Molly Crabapple, narrated by Astra Taylor, who joins us now, author, filmmaker, co-founder of the Debt Collective, a union for debtors. Her newest e book is Remake the World: Essays, Reflections, Rebellions.

Astra, welcome again to Democracy Now! What a movie! And kudos to Molly Crabapple. She is only a gorgeous illustrator and artist. In case you can simply begin off with the title, Your Debt Is Somebody Else’s Asset? Discuss extra about why you’re releasing this at present and what meaning.

ASTRA TAYLOR: Thanks a lot for having me on and for premiering the movie. And completely, Molly and her group, Kim Boekbinder and Jim Batt, did a tremendous job.

Your Debt Is Somebody Else’s Asset. One of many powers of animation is that it permits us to make one thing seen that we are able to’t usually see. A lot of debt, you realize, is invisible. And one factor this movie reveals is it reveals debtors, however it additionally follows the chains of debt again to the individuals who maintain our money owed as belongings, the those that we pay month-to-month, who accumulate the curiosity and costs, you realize, who’re basically the 1%. These debt funds are a type of wealth switch from the poor to the wealthy. And so, this movie, one factor it does, in a playful however actually severe fashion, is present that. So, there’s numerous proof that debt is accelerating inequality, it’s compounding racial inequities, you realize, as a result of, once more, these are — these money owed that weigh us down are any individual else’s investments, and so they’re very, very, very invested in defending these belongings.

NERMEEN SHAIKH: Astra Taylor, I imply, the determine that you just give, a record-breaking $15 trillion of debt, are you able to present some sense, some clarification of how the U.S. bought up to now, $15 trillion?

ASTRA TAYLOR: Properly, as this movie reveals, you realize, in seven — lower than seven minutes, we journey by way of hundreds of years. So, debt is older than capitalism. Debt is absolutely historic. However there’s one thing concerning the type of capitalism we reside underneath the place debt is absolutely central.

So, we are able to, for instance, assume again to the Seventies. You already know, a lot of this debt, as I say within the animation, didn’t exist just a few generations in the past. Properly, what’s occurred? Wages have stagnated. Laws on the monetary sector have been rolled again. They rolled again usury limits, the bounds on how a lot curiosity might be collected. So, what’s occurred is that folks have basically been compelled to borrow. Individuals don’t reside past their means; they’re denied the means to reside. So, working individuals are robbed twice. You’re underpaid on the job, and then you definately’re charged curiosity since you’re having to borrow pupil loans to get an schooling, you’re having to enter debt for medical care, you’re having to take out a payday mortgage or a bank card to place meals on the desk. So debt has completely exploded.

That $15 trillion is a mortgage, mortgage debt for folks — we’ve got to enter debt to obtain housing; $770 billion of bank card debt. As I say within the movie, plenty of that’s medical debt as a result of folks don’t have sufficient healthcare on this nation. If in case you have common healthcare, medical debt doesn’t exist. So that is completely an issue that isn’t simply intrinsic to human existence. It’s a consequence of political and financial selections. And as this case has developed, the collectors, the monetary sector have amassed increasingly energy over Washington. And that’s why it’s so essential to inform the financial story and the political story aspect by aspect, as this movie does.

NERMEEN SHAIKH: Astra, one of many issues that’s very putting and, after all, additionally disturbing within the movie is the truth that you say that People, on common now, after they die, owe $62,000 in debt. Are you able to clarify what occurs to this debt after somebody passes away? Is it erased, or is it handed on to the subsequent technology?

ASTRA TAYLOR: Yeah, $62,000 of debt, that’s an immense quantity. So, not all is actually handed on to folks’s household and heirs, however what it does is it impedes households’ potential to construct intergenerational wealth. So, what we’ve got is a few folks, who’ve belongings, constructing into intergenerational wealth, and others who’re by no means in a position to do this. They’re by no means capable of get forward. So, that is notably true, we see this, with the racial wealth hole on this nation, which is for the median households about 10 to 1. For households who’ve pupil debt, the racial wealth hole between Black and white households swells to twenty to 1. So, it impedes folks’s potential to construct wealth and to thrive.

And it additionally underscores — I believe that highly effective picture of a coffin underwater with that quantity on it simply underscores the truth that debt is a matter of life and demise for folks. We’re seeing this proper now because the Biden administration is threatening to activate pupil mortgage funds January thirty first. We’re seeing debtors which can be simply completely not prepared for that, people who find themselves overwhelmed with nervousness, making them — you realize, compounding their stress. You already know, we’re simply seeing that that is one thing that’s actually severe for folks, and I believe that illustration actually drives that time residence.

AMY GOODMAN: And also you say that President Biden might wipe out the debt along with his signature. Are you able to speak concerning the position he’s performed in increasing each pupil and bank card debt, and what energy he has proper now?

ASTRA TAYLOR: Sure. Because the animation reveals, Biden is a part of an extended line of American presidents who’ve sided with collectors. I imply, we’ve got what some students name a collectors’ structure. The battle between debtors and collectors is absolutely important to the founding of this nation.

However Biden has performed a very vital position as the previous senator from Delaware, which is the bank card capital of the world. So he was completely instrumental in passing 2005 chapter reform, which was one thing that bank card industries actually needed. It repealed chapter protections for pupil debtors with non-public loans. So he has been on the fallacious aspect of this.

That stated, due to organizing, due to the group the Debt Collective, which I based and I arrange with, and different activists, you realize, he was compelled to run on a promise of $10,000 across-the-board debt reduction, and much more for college kids from sure schools. And he has the authority. We all know this. The exact same authority that Donald Trump used to do the scholar mortgage fee pause is the authority that President Biden can use to cancel all federal pupil debt — not simply $10,000, not simply $50,000, however all of it.

And it’s completely an ethical crucial that he does it. A current research confirmed that 90% of totally employed pupil debtors usually are not financially safe sufficient for the funds to return on. And it’ll enhance the financial system. It should have all of those useful results. It should slender that racial wealth hole I discussed from 20 to 1 for debtors to 3 to 1 between Black and white households. And so we’re organizing for that. The Debt Collective is asking for every week of motion, with an motion in D.C. January 18th. We have now to push him and make him do it, similar to the movie says.

AMY GOODMAN: And who does get bailed out? I imply, it’s not like, “Properly, we simply can’t afford to wipe out these money owed.” Discuss concerning the payday mortgage operators, the massive firms.

ASTRA TAYLOR: We will’t afford to not wipe out these money owed. Once more, if we’ve got a jubilee, we, the 99%, will all be richer consequently. There are such a lot of advantages to this. However a jubilee, as you’ve identified right here, you realize, just isn’t a pie-in-the-sky thought. Debt cancellation occurs on a regular basis. It simply occurs for rich people and for companies, these firms who’ve the attorneys who advise them on their strategic defaults, the banks that may get bailed out after 2008.

So, what we noticed in 2020 when the coronavirus hit was the federal government stepping in in an enormous manner, shopping for up a whole lot of billions of {dollars} of dangerous company debt belonging to the largest firms within the nation, providing payday lenders and different predators forgivable loans. You already know, we have to prolong this mercy, this generosity, to debtors, who haven’t executed something fallacious. Individuals are in debt by design. This can be a system that provides folks no different choices for making ends meet. That’s what occurs when you’ve a rustic with a minimal wage of $7.25. So, a jubilee is feasible and is critical, and debtors have to struggle for it.

AMY GOODMAN: Astra Taylor, we wish to thanks a lot for being with us, author, filmmaker and co-founder of the Debt Collective, a union for debtors; newest e book, Remake the World: Essays, Reflections, Rebellions; co-writer and narrator of the brand new animated brief movie that we’ve simply premiered, Your Debt Is Somebody Else’s Asset.

Subsequent up, we have a look at “The Invisible Wall: Contained in the Secretive Libyan Prisons That Maintain Migrants Out of Europe.” Stick with us.