Sponsored content. Us Weekly receives compensation from this article, as well as for purchases made if you click on a hyperlink and purchase something below.

We might listen to Spotify or Apple Music during work, open our mail to locate our latest Birchbox packages, make a delicious meal with our HelloFresh ingredients, then switch between Netflix and Hulu so we can catch up on our favorite shows. Oh, and we’ll pull up HBO Max if it’s a movie night, and definitely Disney+ when Obi-Wan Kenobi premieres!

This sounds good, right? You don’t realize that all these subscriptions are expensive. You might even have a bunch of subscriptions you’re still paying for that you don’t even realize you have! If you’re wondering why your bank account is dwindling, it’s time to get organized. But you don’t have to do it by yourself!

Here’s where Truebill can help.

See it!

Try Truebill for free today — and go Premium starting at just $3 a month!

Truebill is a personal financial app that has over 2 million users. It has helped its members save more than $100 million over the past 5 years. Do you want to save more and spend less while managing your money like never before. A free download could help you regain control of your finances!

While the app is free to use, you can also sign up for Premium if you’d like extra features. Keep reading to learn about our favorite features and benefits from subscription organization and beyond.

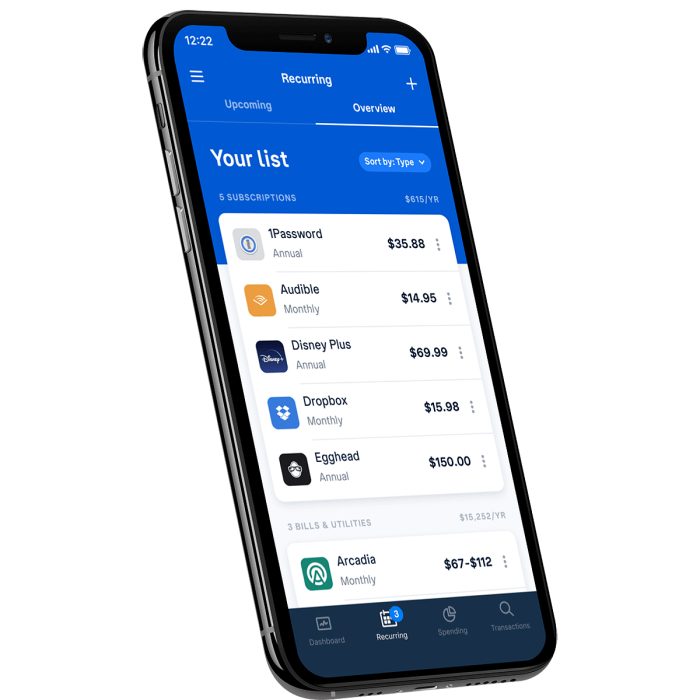

We think just about anyone would be thrilled to learn about Truebill’s subscriptions cancellation service. Truebill can cancel unwanted subscriptions with just one tap. Realize you’ve been paying for a magazine that never even comes? Still have an active membership on a message board you haven’t used in a decade? They’re gone! Truebill offers a cancellations concierge, so you don’t have to sit on the phone with customer service as they beg you to stay!

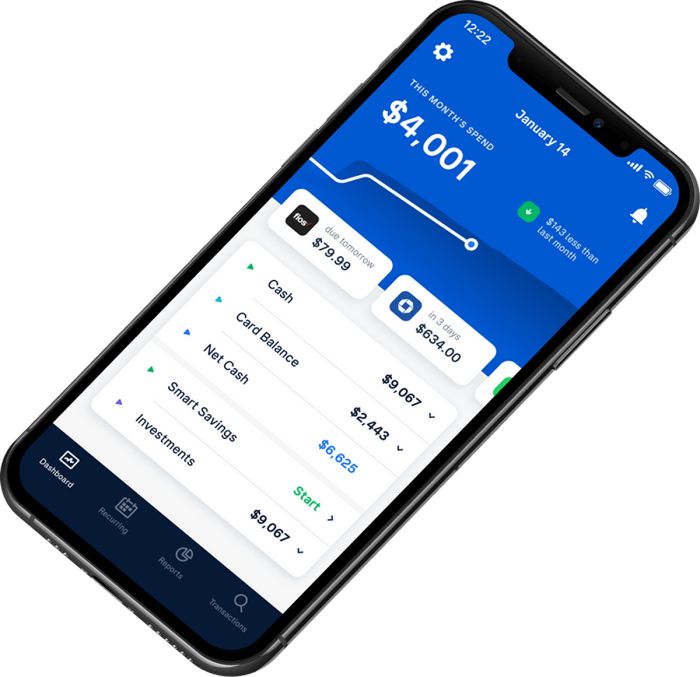

Truebill connects all of your bank accounts, credit cards, and other financial institutions to provide you with a complete overview of your spending and earnings. It’s not just about a wide overview though. Truebill lets you track your spending by category, and create a budget that is based on your personal spending habits. You can monitor your goals using the app, which includes a dashboard that breaks down your expenditures. It’s easy to understand, and you won’t need a financial background to use it.

See it!

Try Truebill for free today — and go Premium starting at just $3 a month!

Another amazing feature is Truebill. Truebill can help you lower your bills by negotiating for you. Premium members can also receive pay advances via the app. Goodbye, overdraft fees! We didn’t know you.

We want to mention that Truebill can help monitor and understand credit scores. Truebill can quickly alert you if there are any suspicious charges. This is also great if you’re looking to buy a house or get a car loan — something where your credit score can play a big deciding factor.

Let’s see, what about it? Truebill makes managing your money easy. Try the app today to see how easy it can be!

Try Truebill for free today — and go Premium starting at just $3 a month!

This post is brought to you by Us Weekly’s Shop With Us team. The Shop With Us team strives to highlight products that readers might find useful or interesting. This includes face masks, self-tanners and Lululemon style leggings. The selection of products and services is not meant to be an endorsement by Us Weekly or any celebrity mentioned in this post.

Shop With Us may be offered products to try out by manufacturers. Us Weekly also receives compensation from the manufacturer for products featured in our articles. This does NOT influence our decision to recommend or not recommend a product or service. Shop With Us operates independently of the advertising sales team. We welcome your feedback at ShopWithUs@usmagazine.com. Happy shopping!