After Elizabeth Woodruff and her husband were sued by New York Hospital for almost $10,000, they took on three jobs.

Ariane Buck, a young father in Arizona who sells health insurance, couldn’t make an appointment with his doctor for a dangerous intestinal infection because the office said he had outstanding bills.

Allyson Ward, her husband, and their children accumulated credit cards, borrowed money from family, and delayed repaying student loan debts after they were left with $80,000 in debt. Ward, a nurse practitioner took on additional nursing shifts, working nights and days.

“I wanted to be a mom,” she said. “But we had to have the money.”

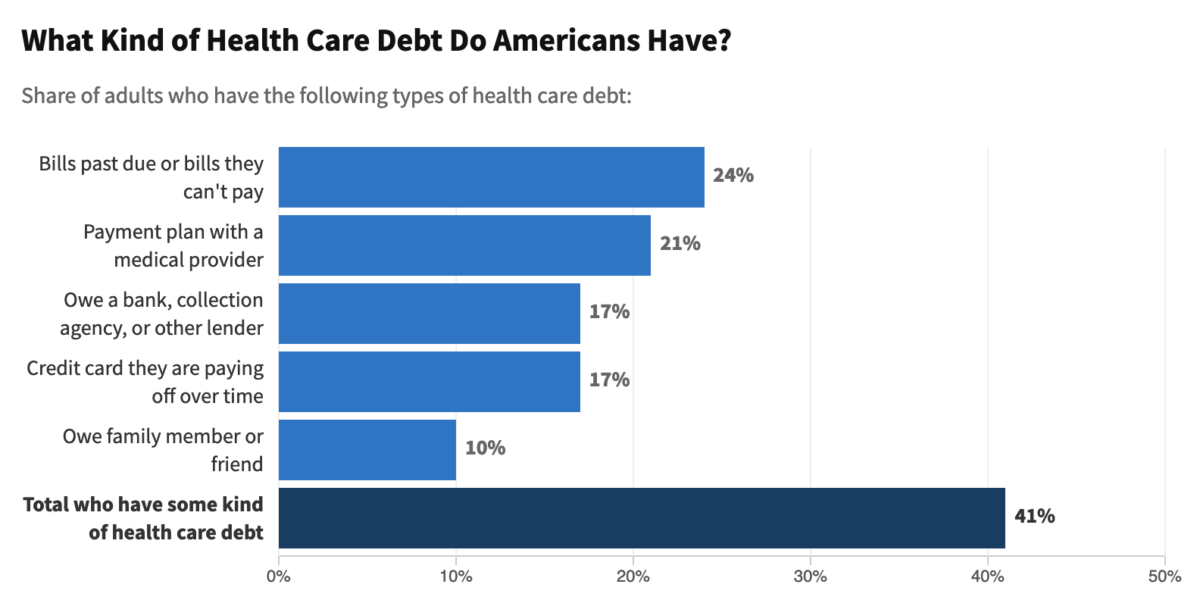

The three are among more than 100 million people in America ― including 41% of adults ― beset by a health care system that is systematically pushing patients into debt on a mass scale, an investigation by KHNAnd NPR shows.

Despite the fact that Congress and White House have been paying more attention to this issue, the investigation has revealed a much deeper problem than previously reported. Because a large portion of the debt patients have is hidden in credit card balances, loans from relatives, and payment plans to hospitals or other medical providers.

To calculate the true burden and extent of this debt, please use the KHN-NPRInvestigative work continues a nationwide poll conducted by KFFThis project was funded by the Kaiser Family Foundation. The poll was designed to capture not just bills patients couldn’t afford, but other borrowing used to pay for health care as well. The Urban Institute and other research partner have also provided new analysis of credit bureau and hospital billing data. And KHNAnd NPRReporters conducted hundreds upon thousands of interviews with patients and doctors, as well as health industry leaders, consumer advocates and researchers.

The picture is grim.

In the past five years, more than half of U.S. adults report they’ve gone into debt because of medical or dental bills, the KFF poll found.

One quarter of adults with more than $5,000 in health care debt are over 25. And about 1 in 5 with any amount of debt said they don’t expect to ever pay it off.

“Debt is no longer just a bug in our system. It is one of the main products,” said Dr. Rishi Manchanda, who has worked with low-income patients in California for more than a decade and served on the board of the nonprofit RIP Medical Debt. “We have a health care system almost perfectly designed to create debt.”

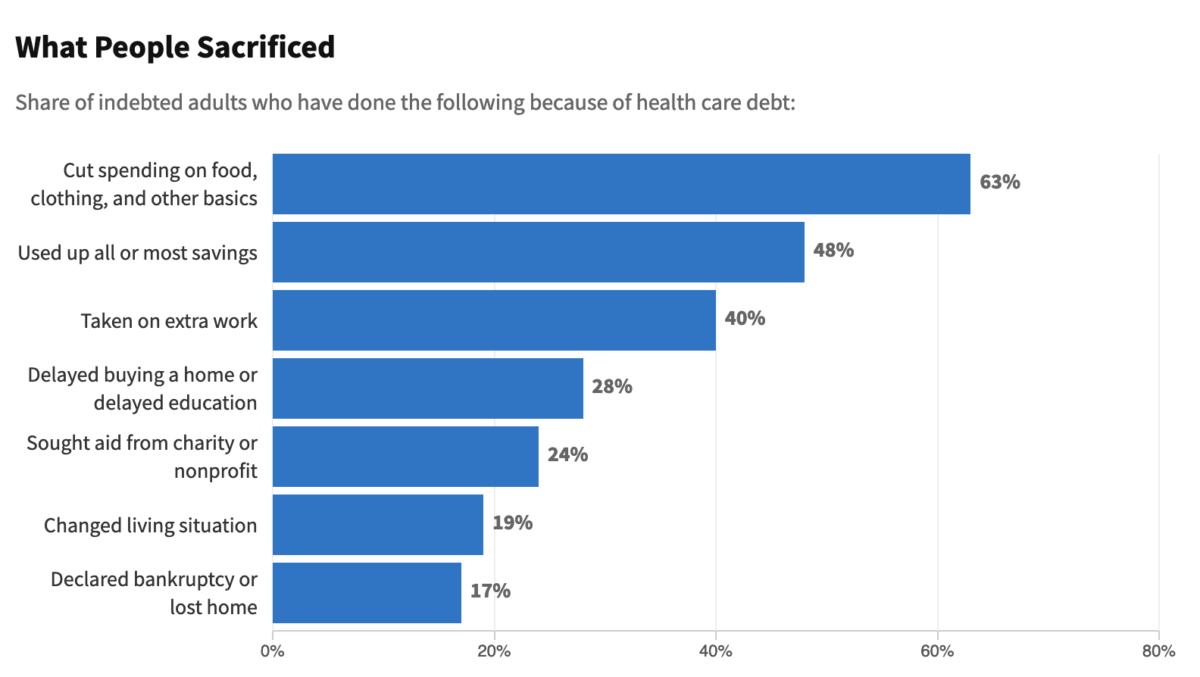

The financial burden is causing families to cut back on food and other necessities. The poll revealed that millions of people are being forced from their homes or into bankruptcy.

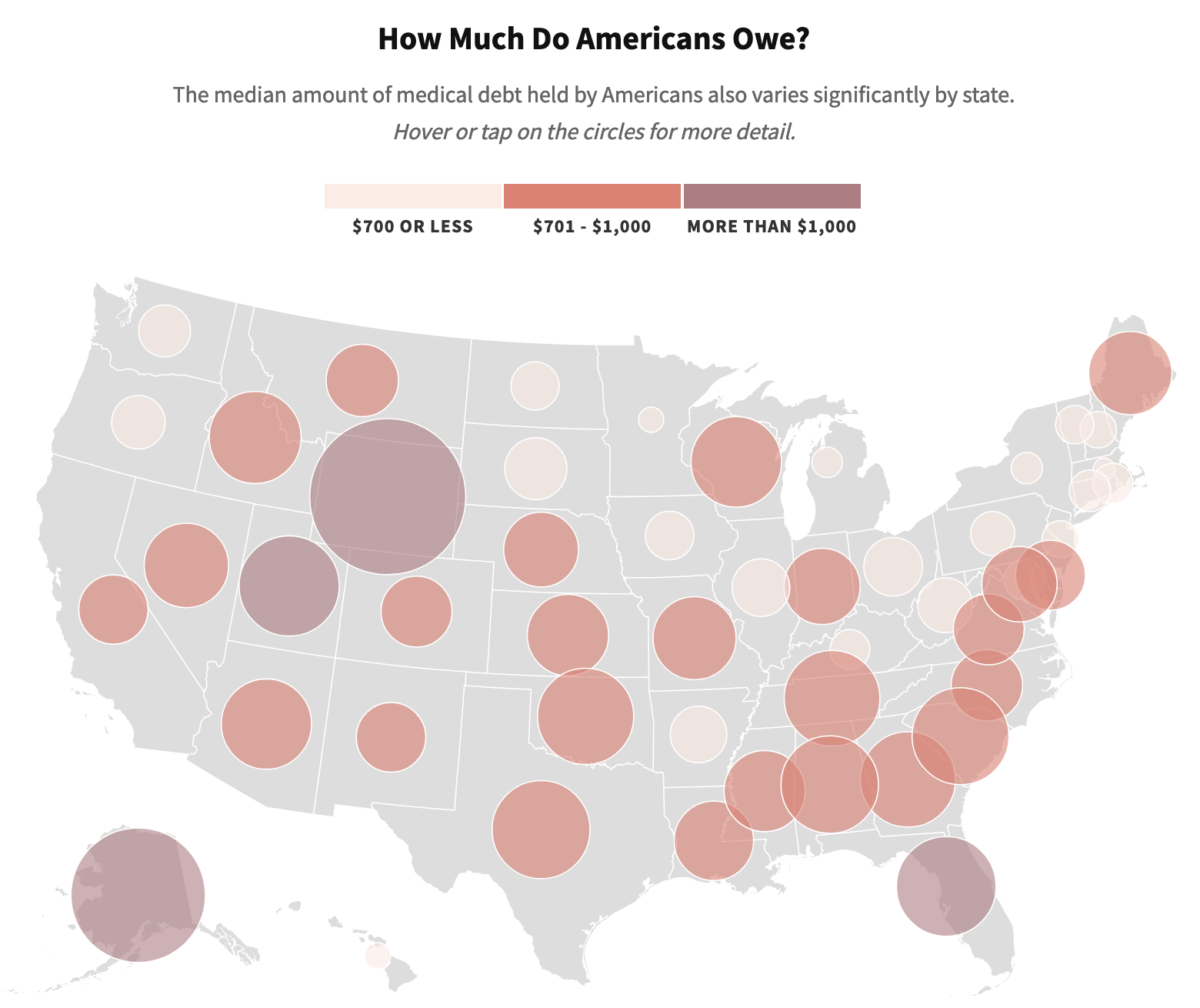

Patients with chronic diseases such as cancer and those with medical debt are faced additional hardships. According to the U.S. Census Bureau, the debt levels in the most disease-prone U.S. states can be as high as three to four times those in the healthiest. an Urban Institute analysis.

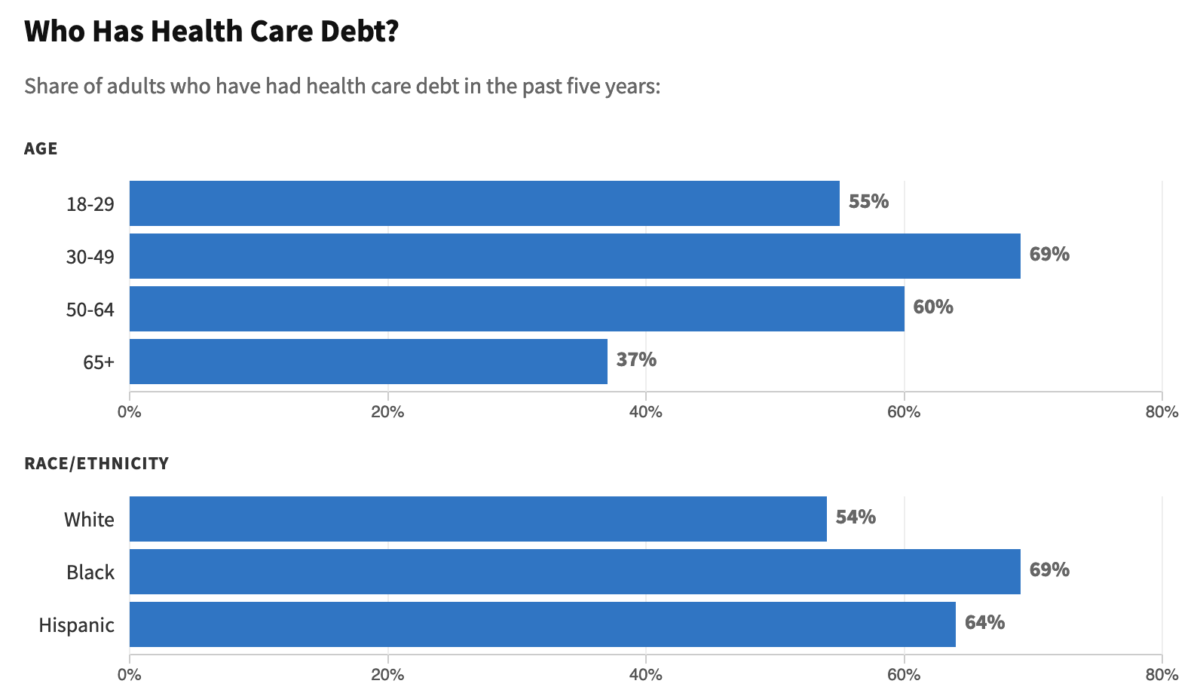

The debt is also causing racial inequalities to worsen.

And it is preventing Americans from saving for retirement, investing in their children’s educations, or laying the traditional building blocks for a secure future, such as borrowing for college or buying a home. According to the KFF poll, debt from health care was nearly twice as common among adults under 30 than it is for those over 65.

Perhaps the most perverse thing about medical debt is that it prevents patients from seeking care.

About 1 in 7 people with debt said they’ve been denied access to a hospital, doctor, or other provider because of unpaid bills, according to the poll. An even greater share ― about two-thirds ― have put off care they or a family member need because of cost.

“It’s barbaric,” said Dr. Miriam Atkins, a Georgia oncologist who, like many physicians, said she’s had patients give up treatment for fear of debt.

Despite the landmark Affordable Care Act of 2010, patient debt continues to mount.

The law expanded coverage to insurance for tens of thousands of Americans. It also brought in years of strong profits for the medical sector, which has steadily increased prices over the past decade.

According to the 2019 Hospital Profit Report, hospitals recorded their highest ever profit year. They had an aggregate profit margin 7.6%. federal Medicare Payment Advisory Committee. Many hospitals survived the pandemic.

Many Americans have found that the law has failed to deliver on its promise of affordable care. Instead, they’ve faced thousands of dollars in bills as health insurers shifted costs onto patients through higher deductibles.

Now, a highly lucrative industry is capitalizing on patients’ inability to pay. Hospitals and other medical providers are urging millions of people to get credit cards and other loans. According to a study, these loans generate profits for lenders who top 29% and stick patients with high interest rates. research firm IBISWorld.

Patient debt is also sustaining a shadowy collections business fed by hospitals ― including public university systems and nonprofits granted tax breaks to serve their communities ― that sell debt in private deals to collections companies that, in turn, pursue patients.

“People are getting harassed at all hours of the day. Many come to us with no idea where the debt came from,” said Eric Zell, a supervising attorney at the Legal Aid Society of Cleveland. “It seems to be an epidemic.”

Indebt to Hospitals, Credit Card, and Relatives

America’s debt crisis is driven by a simple reality: Half of U.S. adults don’t have the cash to cover an unexpected $500 health care bill, according to the KFF poll.

As a result, many simply don’t pay. Medical debt is now the most common type of debt in consumer credit records due to the flood of unpaid bills.

58% of all debts in collections as of last year were for a medical bill. according to the Consumer Financial Protection Bureau. That’s nearly four times as many debts attributable to telecom bills, the next most common form of debt on credit records.

However, the amount of medical debt that credit reports show is only a fraction the amount Americans owe to health care. KHN-NPR investigation shows.

- About 50 million adults ― roughly 1 in 5 ― are paying off bills for their own care or a family member’s through an installment plan with a hospital or other provider, the KFF poll found. Such debt arrangements don’t appear on credit reports unless a patient stops paying.

- One in ten owe money a friend or relative who paid their medical and dental bills.

- Credit cards are racking up more debt as patients charge their accounts and build up balances. This adds to the high interest rates and owing money for care. One in six adults is paying off a dental or medical bill that they put on a credit card.

How much medical debt Americans have in total is hard to know because so much isn’t recorded. However, there is an earlier version. KFF analysisOf federal dataIt was estimated that the collective medical debt reached at least $195 trillion in 2019, more than the GDP of Greece.

The credit card balances, which also aren’t recorded as medical debt, can be substantial, according to an analysis of credit card recordsThe JPMorgan Chase Institute. The financial research group found that the typical cardholder’s monthly balance jumped 34% after a major medical expense.

The monthly balances fell as people paid down their debts. They remained 10% higher than they were before the medical expense for a year. Balances for cardholders in a similar group without major medical expenses remained relatively flat.

It’s unclear how much of the higher balances ended up as debt, as the institute’s data doesn’t distinguish between cardholders who pay off their balance every month from those who don’t. About half of all cardholders have a balance on their cards, which can add interest and fees.

Large and small amounts of debt

Many Americans are not likely to owe much on their medical or dental bills. The KFF poll found that about a third of Americans owe less $1,000.

Even small debts can be a burden.

Edy Adams, a Texas 31-year-old medical student, was pursued by debt collectors over years for a medical examination she received after being sexually assaulted.

Adams had just graduated college and was currently living in Chicago.

The perpetrator was never caught by police. Adams received calls from collectors two-years after the attack. They claimed she owed $130.68.

Illinois law prohibits victims being charged for such tests. Adams was unable to explain the error. She said that the calls continued to come in, each forcing Adams to relive the worst days of her life.

Adams would often cry on the phone when collectors called. “I was frantic,” she recalled. “I was being haunted by this zombie bill. I couldn’t make it stop.”

A health care debt can also be very dangerous.

Sherrie Foy, 63, and her husband, Michael, saw their carefully planned retirement upended when Foy’s colon had to be removed.

The couple moved to rural Virginia after Michael retired from Consolidated Edison, New York. Sherrie had the space to care fo the horses that she had rescued.

The couple had worked hard to save. Con Edison provided retiree health insurance. But Sherrie’s surgery led to numerous complications, months in the hospital, and medical bills that passed the $1 million cap on the couple’s health plan.

When Foy couldn’t pay more than $775,000 she owed the University of Virginia Health System, the medical center sued, a once common practice The university stated that it had reined in. The couple declared bankruptcy.

The Foys cash in a life policy to pay a bankruptcy lawyer. They also liquidated savings accounts that they had set up to support their grandchildren.

“They took everything we had,” Foy said. “Now we have nothing.”

According to the KFF survey, about 1 in 8 Americans with medical debt owe $10,000 and more.

Although most expect to repay their debt, 23% said it will take at least three years; 18% said they don’t expect to ever pay it off.

Medical Debt’s Wide Reach

The shadows of American healthcare have long been home to debt.

In the 19th century, male patients at New York’s Bellevue Hospital had to ferry passengers on the East River and new mothers had to scrub floors to pay their debts, according to a history of American hospitalsCharles Rosenberg

The arrangements were however informal. More often, physicians simply wrote off bills patients couldn’t afford, historian Jonathan Engel said. “There was no notion of being in medical arrears.”

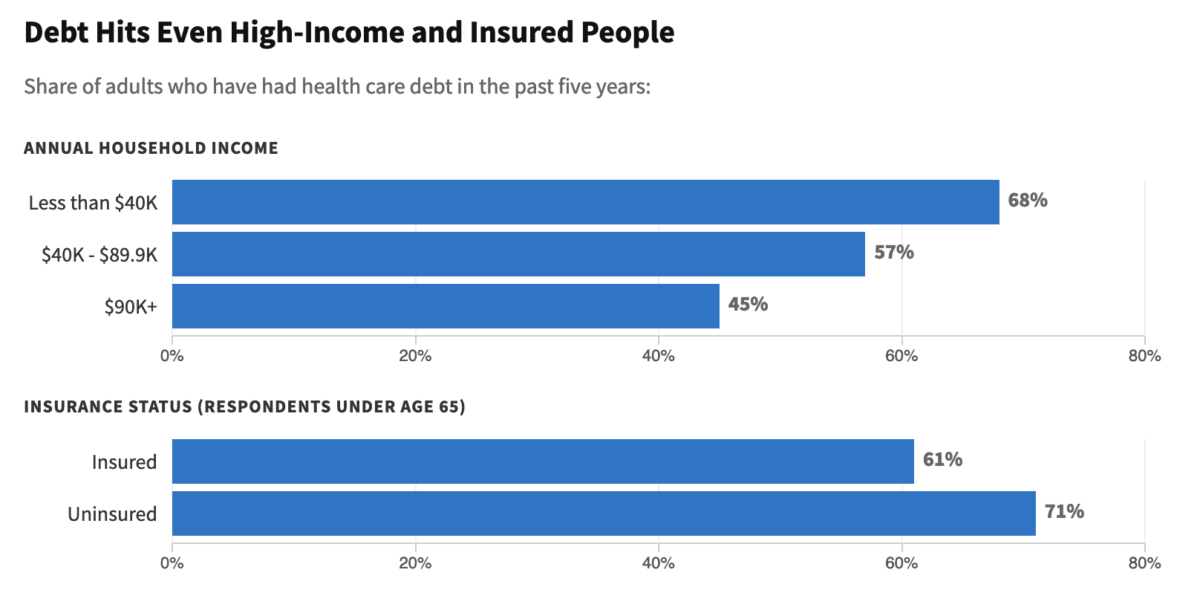

Today, almost every American household is burdened by medical and dental debt.

The KFF poll found that nearly half of Americans who earn more than $90,000. per year have had to pay off health care debts in the last five years.

Debt is more common in women than in men. Parents have higher rates of health care debt than those who don’t have children.

The hardest hit by the crisis are the uninsured and the poorest.

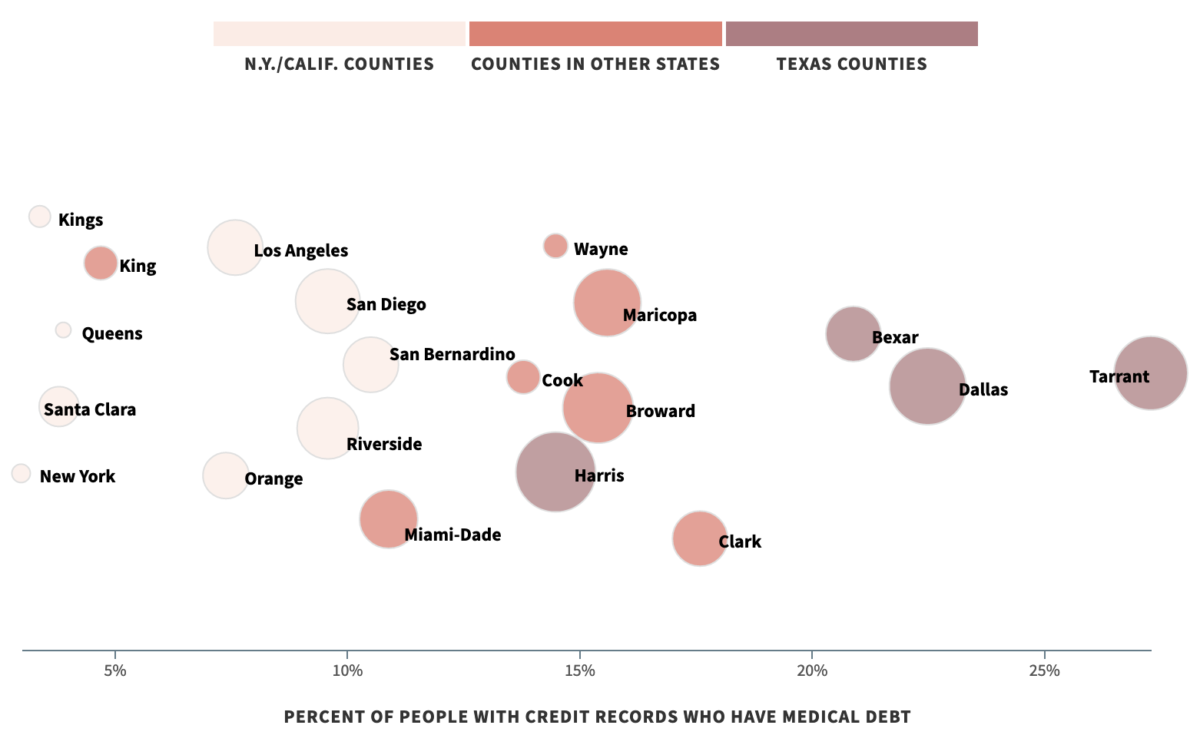

An analysis of credit records by Urban Institute revealed that debt is most prevalent in the South. Insurance protections there are weaker, many of the states haven’t expanded Medicaid, and chronic illness is more widespread.

The poll found that black adults are 50% more likely to owe money than whites, while Hispanic adults are 35% more likely. (Hispanics may be of any race, or combination of races.

In some places, such as the nation’s capital, disparities are even larger, Urban Institute data shows: Medical debt in Washington, D.C.’s predominantly minority neighborhoods is nearly four times as common as in white neighborhoods.

Joseph LeitmannSanta Cruz, chief executive at Capital Area Asset Builders (a nonprofit that provides financial counselling to low-income Washington residents), said that debt can be crippling in minority communities already struggling with limited educational and economic opportunities. “It’s like having another arm tied behind their backs,” he said.

Young people can be prevented from saving, completing their education, or finding a job by medical debt. One study of credit data revealed that debt from medical care is most common in the 20s and 30s for typical Americans, and then it decreases as they get older.

Cheyenne Dantona’s medical debt derailed her career before it began.

Dantona, 31 years old, was diagnosed with blood carcinoma while she was still in college. Dantona went into remission after the cancer went away. However, when she changed her health plans, Dantona was hit with thousands in medical bills. One of her primary providers was not in network.

She signed up for a medical credit card only to find herself stuck paying more interest. Other bills were sent to collections, which dragged down her credit score. Dantona still dreams of working with injured and orphaned wild animals, but she’s been forced to move back in with her mother outside Minneapolis.

“She’s been trapped,” said Dantona’s sister, Desiree. “Her life is on pause.”

Barriers to Care

Desiree Dantona explained that the debt has made it difficult for her sister to seek treatment for her cancer.

Medical providers say this is one of the most pernicious effects of America’s debt crisis, keeping the sick away from care and piling toxic stress on patients when they are most vulnerable.

The financial strain can slow patients’ recovery and even increase their chances of death, cancer researchers have found.

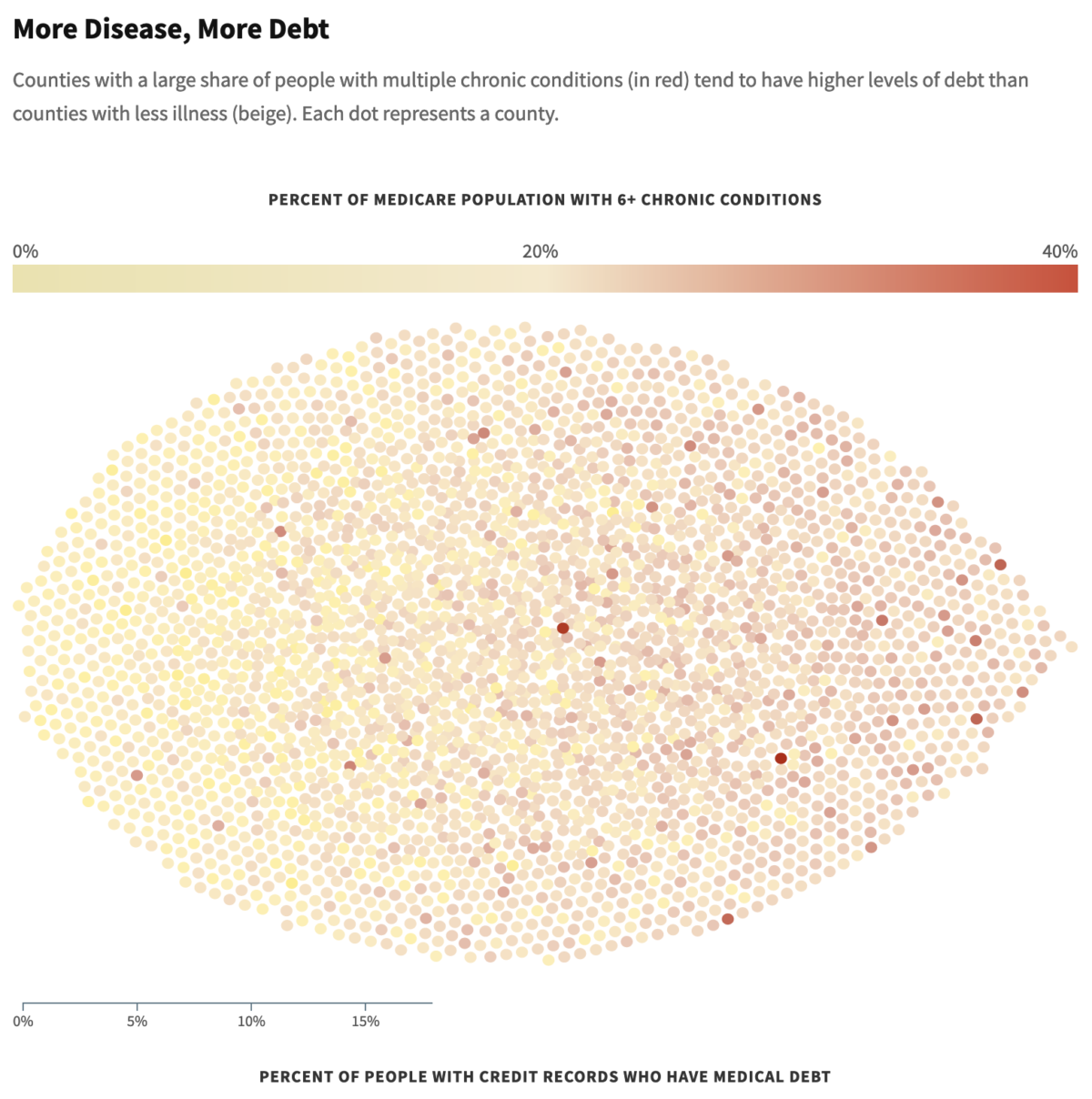

The Urban Institute found that the link between sickness, debt, and illness is a significant feature of American healthcare. They analyzed credit data and other demographic data about poverty, race, health, and status.

The U.S. county with the highest percentage of residents suffering from multiple chronic conditions like diabetes or heart disease has the highest amount of medical debt. This makes illness a stronger predictor for medical debt than insurance or poverty.

Nearly 25% of Americans live in 100 U.S. states with the highest rates of chronic disease. This compares to fewer than 1/10 in the most healthy.

The problem is so prevalent that even doctors and business leaders admit that American health care has been marred by debt.

“There is no reason in this country that people should have medical debt that destroys them,” said George Halvorson, former chief executive of Kaiser Permanente, the nation’s largest integrated medical system and health plan. KP has a generous financial assistance policy, but sometimes it sues patients. (The health care system is not affiliated with KP. KHN.)

Halvorson pointed out that the key driver of the current debt crisis was the rise of high-deductible insurance. “People are getting bankrupted when they get care,” he said, “even if they have insurance.”

Washington’s Role

The Affordable Care act provided financial protections to millions of Americans. It increased health coverage and set insurance standards that were supposed limit patients’ need to pay out of pocket.

The law was effective through some measures research shows. After California expanded coverage, the monthly payday loan use in California dropped 11%.

But the law’s caps on out-of-pocket costs have proven too high for most Americans. Federal regulations allow for individual plans with out-of pocket maximums of up to $8,000.

The law did nothing to stop the rise of high-deductible plans that have become standard over a decade. This has meant that many Americans are forced to pay thousands of dollar out of their own pockets before they get coverage.

According to an analysis, the average annual deductible for a single worker covered by job-based insurance was $1,400 last year. This is almost four times the amount it was in 2006. annual employer surveyKFF. Family deductibles may exceed $10,000

While health plans are making patients pay more, hospitals, drugmakers and other medical providers are increasing their prices.

Prices for medical care rose 16% between 2012 and 2016, almost four times the rate that overall inflation. a reportThe nonprofit Health Care Cost Institute discovered the results.

Many Americans are almost certain to end up in debt because of the combination high prices and high outof-pocket expenses. KFF poll results showed that 6 out 10 working-age adults covered by insurance have gone into debt to get care in the last five years. This rate is only slightly lower than the rate for the uninsured.

Even Medicare coverage can leave patients liable for thousands of dollars for drug and treatment charges. studies show.

The poll revealed that nearly a third of seniors owe money for their care. And 37% of these said they or someone in their household have been forced to cut spending on food, clothing, or other essentials because of what they owe; 12% said they’ve taken on extra work.

The growing burden of medical debt has attracted the attention of regulators, elected officials, and industry leaders.

After warnings from the Consumer Financial Protection Bureau in March, the major banks were shut down. credit reporting companies saidThey would eliminate medical debts less than $500 and those that had been repaid through consumer credit reports.

The following is the April edition Biden administration announcedA new CFPB crackdown upon debt collectors and an effort by the Department of Health and Human Services, to collect more information on how hospitals offer financial aid.

Patient advocates applauded the actions. However, the changes likely won’t address the root causes of this national crisis.

“The No. “The No. 2, 3, and 4 reasons, that people go into medical debt is they don’t have the money,” said Alan Cohen, a co-founder of insurer Centivo who has worked in health benefits for more than 30 years. “It’s not complicated.”

Buck, a father from Arizona who was denied health care, saw this firsthand while selling Medicare plans for seniors. “I’ve had old people crying on the phone with me,” he said. “It’s horrifying.”

Buck is now 30 and facing his own challenges. He recovered from the intestinal infection but was forced to go to an emergency room in order to pay thousands of dollars for his medical bills.

More piled on when Buck’s wife landed in an emergency room for ovarian cysts.

Today the Bucks, who have three children, estimate they owe more than $50,000, including medical bills they put on credit cards that they can’t pay off.

“We’ve all had to cut back on everything,” Buck said. The children wear hand-me downs. They are reliant on their families for Christmas gifts and school supplies. Extravagances include a dinner out for chili.

“It pains me when my kids ask to go somewhere, and I can’t,” Buck said. “I feel as if I’ve failed as a parent.”

The couple is planning to file for bankruptcy.

About this Project

“Diagnosis: Debt” is a reporting partnership between KHN and NPR exploring the scale, impact, and causes of medical debt in America.

The series draws on the “KFF Health Care Debt Survey,” a poll designed and analyzed by public opinion researchers at KFF in collaboration with KHN journalists and editors. The survey was conducted online and by telephone from February 25 to March 20, 2022 among a nationally representative sample, which included 1,292 adults with current and past health care debts and 382 adults who have had health care debt in recent years. The margin for sampling error is plus/minus 3 percentage point for the whole sample and 3 percentage point for those with current health care debt. The margin of sampling error for results based on subgroups may be greater.

Additional research was done conducted by the Urban InstituteThe company analyzed credit bureau data, as well as other demographic data such as race, poverty, health status, and race to find out where medical debt is concentrated in America and what factors contribute to high levels of debt.

The JPMorgan Chase Institute analyzed records from a sampling of Chase credit card holders to look at how customers’ balances may be affected by major medical expenses.

Reporters from KHNAnd NPRAlso, hundreds of interviews were conducted with patients from across the country. We spoke with doctors, health industry leaders and debt lawyers. We also reviewed scores of studies and surveys on medical debt.

KHN (Kaiser Health News) is a national newsroom that produces in-depth journalism about health issues. With Policy Analysis and Polling, KHNThis is one of three major operating programs. KFF(Kaiser Family Foundation). KFF is an endowed non-profit organization that provides information to the nation on health issues.