The Biden administration on Thursday launched an outline for its fiscal yr 2024 price range. As anticipated, it promotes the identical swampy, big-government agenda as final yr, which the nation desperately must keep away from.

Beneath the administration’s spin, the last word message is that it thinks the federal authorities doesn’t have sufficient energy and management over our households and companies.

These charts, primarily based on updated information from the nonpartisan Congressional Funds Workplace, present simply how off-base Biden’s narrative is and why America wants precisely the alternative from its leaders.

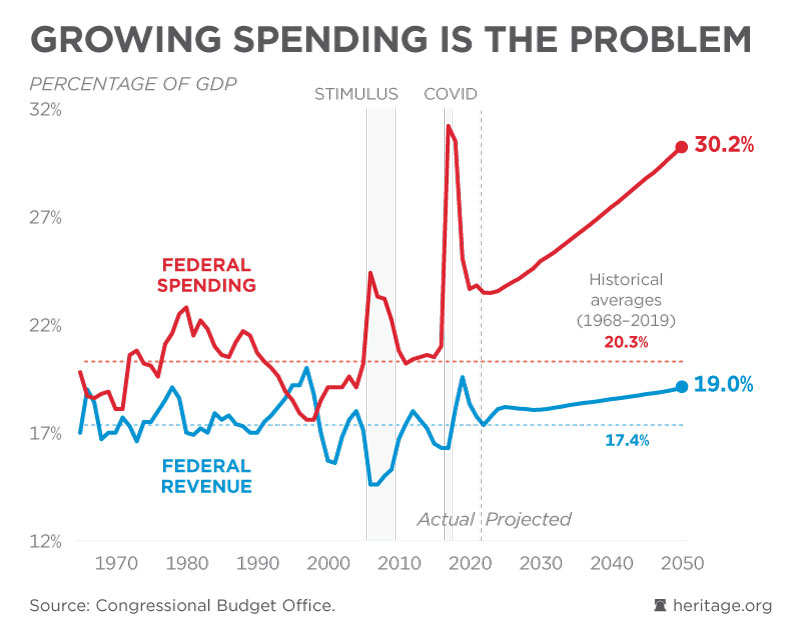

For greater than 50 years previous to the COVID-19 pandemic, federal spending averaged a whisker over 20% of the financial system. That quickly spiked above 30% in 2020 and 2021 as a result of immense (and intensely wasteful) spending spree by Congress.

The nation is on target to return to that extreme degree of spending with out struggle, recession, or a pandemic because the underlying trigger. Merely sustaining the established order of permitting profit and cronyistic applications to develop quicker than the financial system will make “emergency” ranges of spending the brand new regular.

A comparatively brief publicity to firehose-style spending helped drive inflation via the roof. We will solely think about what would occur if that’s allowed to develop into everlasting actuality.

Extremely, the Biden price range would enhance spending above the baseline by $1.85 trillion over the subsequent decade, making the issue even worse. It envisions a mindboggling $10 trillion in spending by 2033.

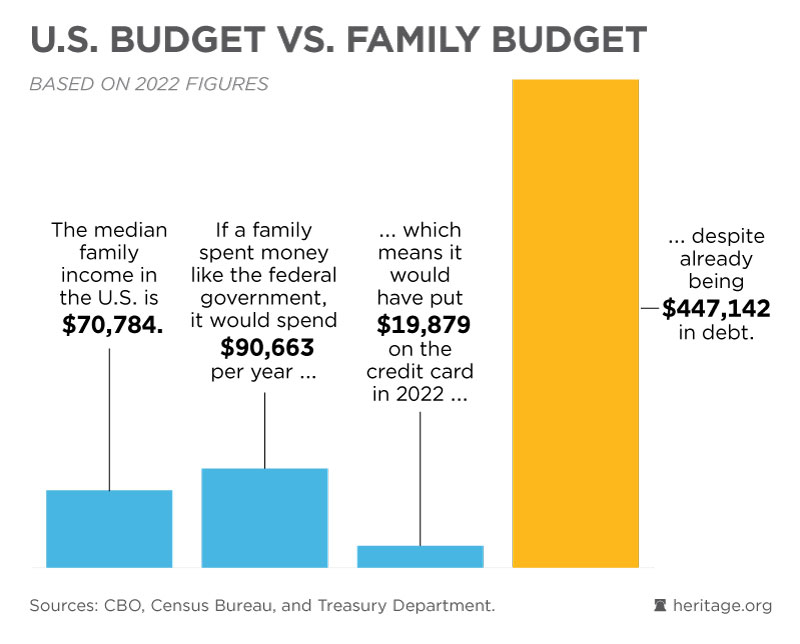

The uncooked numbers concerned with federal budgeting are unattainable to completely comprehend, which makes charts comparable to these so necessary.

In fiscal yr 2022, the federal deficit was the equal of almost $20,000 for a middle-class household. To hold the analogy additional, this household would already be greater than $447,000 in debt, however with no new property to indicate for it.

Any household with such an unbalanced price range can be bankrupt very quickly flat. We shouldn’t assume that the nation can keep away from an identical destiny for for much longer.

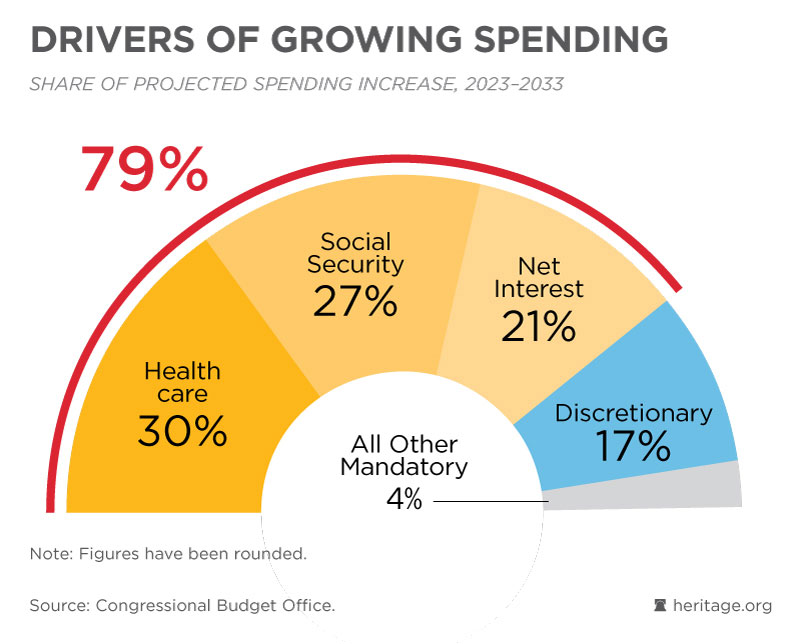

It has been extremely reckless for Washington insiders to imagine low rates of interest can be round without end. With rates of interest rising, the nation is confronted with the prospect of dedicating greater than $1 trillion {dollars} per yr to curiosity funds by the tip of the last decade, and trillions extra per yr not too lengthy after that.

Servicing the federal debt will quickly be an anchor dragging on the financial system, steadily eroding the expansion and prosperity that we take with no consideration. Any try and artificially push rates of interest down would threaten to make inflation worse, squeezing households from each side.

Federal spending is projected to develop a lot quicker than the financial system. Of that unbelievable development, a full 79% would come up from internet curiosity funds, Social Safety, and Medicare.

Too many politicians need to both ignore this actuality, or—like Biden—fake that the answer is to lift taxes whereas refusing to take any significant motion to reform key profit applications with long-term stability in thoughts.

Extremely, Biden is proposing a whopping $4.7 trillion tax enhance within the price range plan, or greater than $35,000 per family.

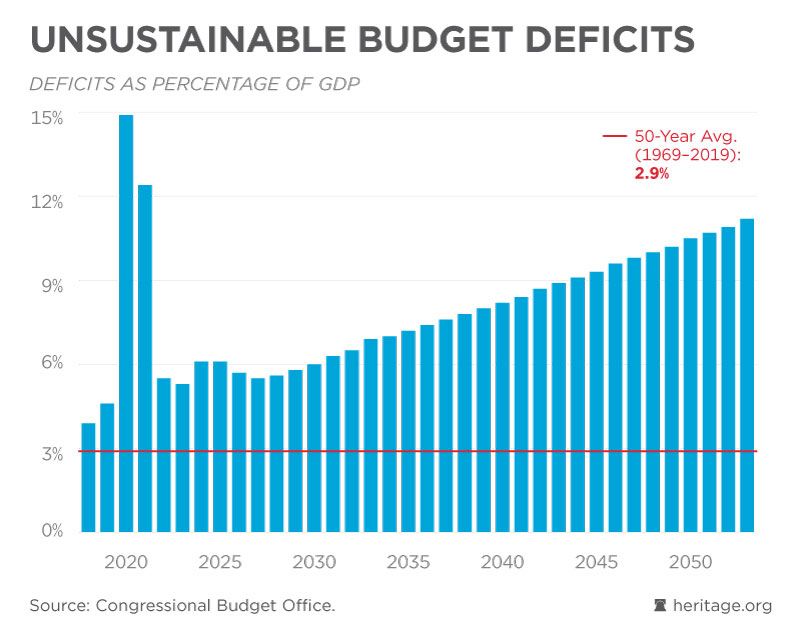

Biden and his staffers like to brag in regards to the 2022 deficit being decrease than it was in 2020. This speaking level is, frankly, misinformation. Biden’s selections have persistently made issues worse.

Additional, the 2022 deficit was nonetheless nicely above the historic common. Until one thing modifications, deficits will probably be twice the historic common by 2029 and preserve climbing from there.

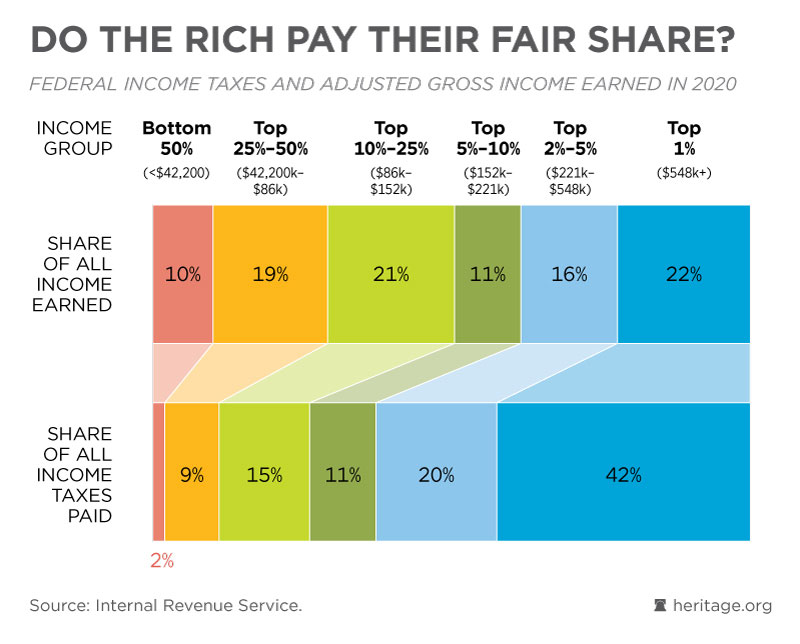

Biden and the Left have spent many years claiming that high-income households don’t pay their “fair proportion” of taxes. The Biden price range’s signature coverage is a tax hike primarily based on that assertion.

As soon as once more, actuality says in any other case. The highest 1% of households pay extra revenue tax than the underside 90% mixed and pay roughly twice as a lot in taxes relative to their share of revenue.

The Left by no means defines what “fair proportion” means, aside from “extra,” they usually usually need to use that “extra” to cowl spending will increase.

It’s essential for People to grasp that elevating taxes on companies and entrepreneurs wouldn’t solely harm financial development and personal funding, however it might additionally totally fail to generate sufficient income to fulfill the Left’s agenda.

The cruel actuality is {that a} European-style authorities with cradle-to-grave advantages would require European-style taxes, and that may imply hammering the middle class with tax hikes.

A correct resolution to federal funds, comparable to that of The Heritage Basis’s Budget Blueprint, would deal with shrinking bloated bureaucracies and reforming applications comparable to Medicare in a method that treats each older and youthful People pretty.

In distinction, Biden’s price range would go away future generations with crushing burdens of debt and taxation. Greater than merely rejecting this bleak imaginative and prescient for the nation, Congress should go in the wrong way if we’re to have any hope.

Have an opinion about this text? To hold forth, please electronic mail letters@DailySignal.com and we’ll take into account publishing your edited remarks in our common “We Hear You” function. Keep in mind to incorporate the url or headline of the article plus your title and city and/or state.